Commentary by Budimex SA CEO Dariusz Blocher to Q1 Financial Results

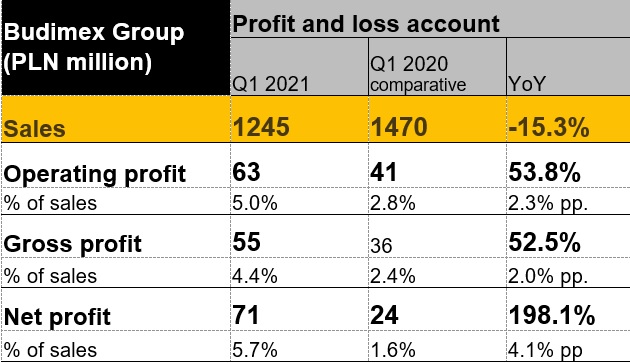

We are pleased with the performance of the Budimex Group in Q1 2021. The gross profit of the Group on continued activities (construction and services) increased from PLN 36 million in Q1 2020 to PLN 55 million in Q1 2021, with profitability growth from 2.4% to 4.4%. The net profit was PLN 47 million, which is an outcome of a material improvement of the result for discontinued operations, i.e. the property development segment. We recorded a 15.3% drop in Group's revenue on sales, with revenue in the service segment growing by 27.2% and in the construction segment dropping by 17.3%. The construction works proceeded slowly mainly because of harsher weather conditions at the beginning of the year and the schedule of the design works for Design & Build road contracts.

Despite the difficulties connected with the growing number of coronavirus cases, we perform most contracts without any major interruptions. We consistently follow the strategy of testing and preventing the spreading of coronavirus but we still faced many new cases at the end of March, just like the rest of the country. The scale of active cases is slightly lower than the level recorded last autumn. Unfortunately, in April two of our employees died.

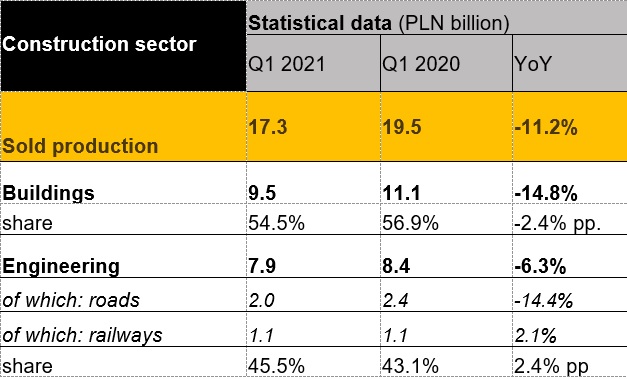

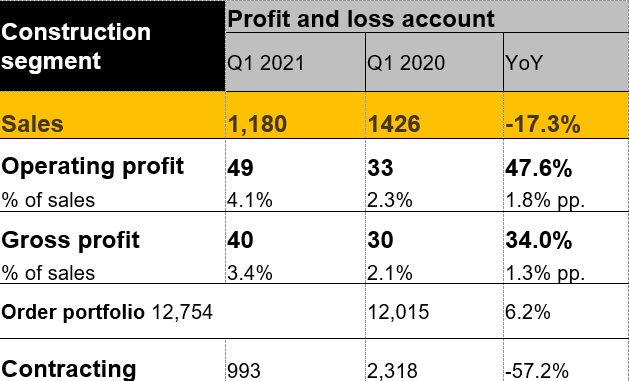

In Q1 2021 construction and assembly production (in current prices) increased by 11.2%. Production in the buildings segment shrunk by 14.8%, with the drop in housing construction limited to 6.7% and in the non-housing part substantially higher – 19.7%. The construction and assembly production in the engineering segment was 6.3%; what is noteworthy is that the railway sector grew by 2.1%. Sales of the construction segment of the Budimex Group was PLN 1,180,000 which was a 17.3% drop.

The contract performance conditions at the beginning of this year versus the same period in the previous year were much harder. The fierce winter slowed down construction works in the majority of fronts. As far as the road industry is concerned, we are at the design stage or we are awaiting the road construction permit for several major projects – revenue on sale for such contracts are relatively low. This is why the dynamic of revenue drop for the construction part of Budimex was higher than reported by the Polish Central Statistical Office (GUS) for the whole sector. Gross return was 3.4% and it was noticeably higher than in Q1 2020, when it was 2.1%. The order portfolio is stable, we are entering into the final stage of difficult energy projects.

However, in the recent months we have been observing disconcerting trends in prices of materials, especially steel, oil, oil derivatives (including asphalt) or polystyrene foam. As a consequence, with the low bid prices, the profitability of the industry may be under pressure in the nearest quarters. In Q1 2021 we have secured contracts with PLN 993 million, with several other jobs of a value above PLN 3 billion in the “waiting room.” The biggest projects with a chance at signing are: the E75 Białystok-Ełk railway line (PLN 587 million, bid with the highest rating), and the S6 Leśnice-Bożepole Wielkie expressway (PLN 584 million, bid with the highest rating).

In April we signed a contract for the construction of a section of the S6 Tri-City Bypass (PLN 581 million) and a contract crucial for strengthening our position in the hydrotechnical market: stage II of the canal across the Vistula Spit worth PLN 467 million. At the end of March 2021 the value of the order portfolio reached PLN 12.8 billion.

The Budimex Group ended Q1 2021 with net cash of PLN 2.1 billion (if we add cash for discontinued operations, it is about PLN 2.5 billion). Compared to 31 December 2020, this was an increase by PLN 403 million. The comfortable and stable net cash resulted in the recommendation for payment of a PLN 426 million dividend, which is PLN 16.70 per share.

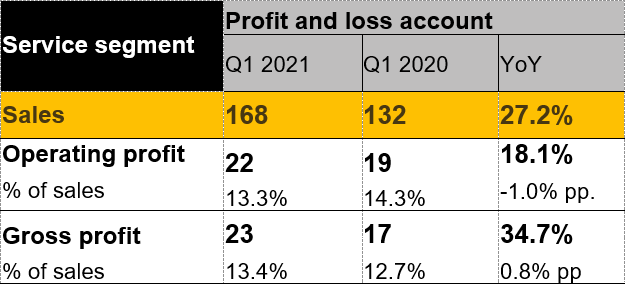

In Q1 2021, the FBSerwis Group continued the growth trends, increasing its per-annum revenue on sales by 27.7%.

Revenue on sales of the FBSerwis Group, which is a driver of the service sector, was PLN 167 million and it grew by 27.7% versus the previous year, which was the result of increased volumes in the waste management segment. Gross profit was PLN 22 million versus the PLN 21 million in Q1 of the previous year. The poorer return in Q1 2021, which failed to follow the revenue growth, was caused by high winter maintenance costs for road contracts.

The growth prospects of the FBSerwis Group for the nearest future are auspicious. In Q2 we started the contracts for waste management from Warsaw. Both current contracts and the contracts undergoing the tender procedures where we submitted the best bids for 12 tasks, in combination with the new signed contracts for waste management in Łódź, will ensure fully efficient use of the resources of our municipal waste management systems at least by the end of 2021.

Long-term development plans of the FBSerwis Group are based on further long-term investments increasing the operational potential of FBSerwis and seeking attractive acquisition targets.

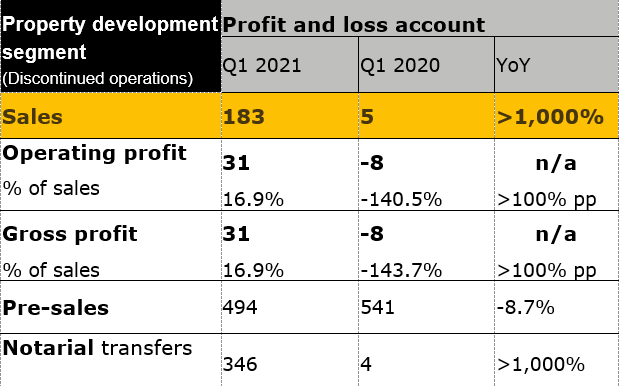

The pre-sales of the development sector in Q1 2021 was 494 apartments and was slightly lower (47 apartments) than in the previous year.

The good re-sales result is the effect of the company’s continuing extensive housing offer and the continuing stable structural demand for housing in the biggest cities. The customers of Budimex Nieruchomości signed 346 notary deeds in Q1 2021 versus the 4 notary deeds in Q1 2020. Revenue on sales was PLN 183 million and gross profit reached PLN 31 million. Budimex Nieruchomości consistently holds a high positive net cash position.

On 22 February, Budimex S.A. decided to conclude a conditional sale agreement for Budimex Nieruchomości Sp. z o.o. As a consequence, the activity of the property development sector is presented in the consolidated profit and loss account as discontinued operations (both for Q1 2021 and in benchmarking data for Q1 2020) according to IFRS 5.

We are entering the construction season with an order portfolio of PLN 12.8 billion. Analysis of the current order portfolio, jobs with a chance of contract signing and out work schedule, we expect the upcoming quarters to bring improvements in the annual dynamic of revenue on sales. Our purpose is to keep the rate of return above the market ratios, which may be under pressure considering the growing cost of materials.

Over the next quarters, we are going to focus on the implementation of our projects, with particular regard to safety, timeliness and quality of work. It will be a challenge to properly manage and control the costs to limit the risk connected with the growing prices of materials. Additionally, one of the objectives in the coming months is to finalise the process of reviewing strategic options in the property development segment and to adapt the business model of the Group to new conditions. We are concurrently working on new business projects in Poland and abroad and on the development of PPP projects.

The future development of the pandemic and its impact on the functioning of the economy, including the availability of staff and the continuity of supplies, are still unknown. We are expecting the epidemic situation to be gradually improving since active coronavirus cases have been dropping both across the Budimex Group and nationwide. We are getting ready to organise vaccinations as an employer, and we are ready to cover about 7,000 people through the programme, mainly our employees and their families.