Commentary on results for Q1 2017

Executive Commentary of the Chairman of the Management Board of Budimex S.A., Dariusz Blocher, on financial data from the consolidated financial statements of the Budimex Group for the first quarter of 2017.

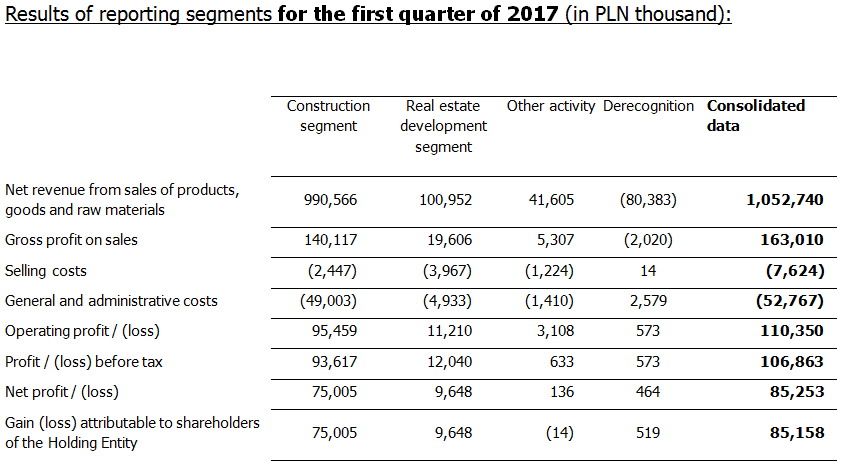

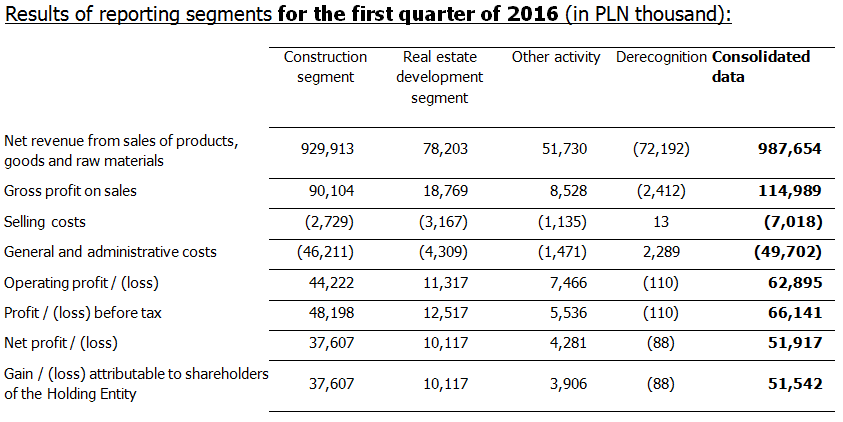

Budimex Group closed the first quarter of 2017 with very good results — high sales for a winter season, a significant improvement in profitability and a record-high order book. In the first quarter of 2017, the sales volume in the construction segment of the Budimex Group increased by 6.5% in comparison to the corresponding period of 2016, amounting to PLN 991 million. During the same period, the construction and assembly production increased by 4.3%. We expect to see accelerated sales dynamics in the Group’s construction segment in the following quarters, primarily due to completion of design works and some contracts performed on the “design and build” basis entering the construction stage.

Improved sales figures were also observed in the real estate development segment. In the first quarter of 2017, 409 flats were sold under notarial deeds, i.e. 69% more than in the same period last year. As a result, the sales volume in the real estate development segment increased by 29.1% year on year, totalling PLN 101 million.

In the first quarter of 2017, Budimex Group achieved very good results, improving its gross margin, operating result and net profit by 42%, 75% and 64%, respectively, as compared with last year’s figures. High profitability of the first quarter resulted mainly from settling ending infrastructure contracts signed 2–3 years ago. Good performance of Mostostal Kraków and the business conducted in the German market also contributed to this result. The value of the Budimex Group order book reached a historic high of PLN 9.3 billion as at the end of March 2017 and is higher by PLN 375 million than the value recorded as at the end of 2016. Within the first three months of 2017, Budimex Group signed contracts worth PLN 1.3 billion. The value of the contracts signed is 15% lower than in the corresponding period of 2016. Contracts waiting to be signed are currently worth PLN 1.5 billion. Over 50% of them are railway projects, where the bids of Group companies have already been selected as the most advantageous ones.

In the first quarter of 2017, we signed a contract for the construction of Trasa Łagiewnicka worth PLN 652 million, which is of key significance for the Kraków agglomeration. The contract is carried out as “design and build” and its performance will not significantly affect the financial results of 2017.

We have been observing a revival in the infrastructure tender market for several months. However, the extent of recovery is lower than expected by the market. At the same time, we can see very strong competition and high price pressure — we did not manage to win the tenders organised by the General Directorate for National Roads and Motorways (GDDKiA) in the first quarter of 2017. At present, we are preparing to submit subsequent bids, inter alia, for the construction of sections of S61, S19 and S7 roads. We are also still focusing on acquiring new railway contracts. We have managed to win contracts worth PLN 1.1 billion to date.

In the first quarter of 2017, we observed a decrease in the cash level, which is typical of this period. In spite of that, as at the end of the first quarter of 2017, Budimex Group maintained its net cash position at the satisfying level of PLN 2.0 billion, comparable to the year before.

Pre-sales of flats in the first quarter of 2017 increased by more than 20% in the Polish housing market as compared to the corresponding period of the previous year. In line the market trend, we observed an increase in the number of pre-sold flats by 24% in the Budimex Group. Over the first three months of 2017, pre-sales reached the level of 392 flats in comparison to 317 flats in the same period last year. In the first quarter of 2017, we commenced the implementation of three new projects — in Gdańsk, Kraków and Warsaw, for over 570 flats in total. In order to satisfy the continuously growing demand, we are looking for attractive locations for new investment projects. In the first quarter of 2017, we purchased a plot of land in Warsaw which will enable us to build over 1,000 flats. We are currently building more than 3,800 new flats, of which 1,258 are on offer for our customers as not pre-sold flats.

Despite high sales under notarial deeds, the operating result and the net profit for the real estate development segment in the first quarter of 2017 remain at a level similar to that in the corresponding period of the previous year. This effect was anticipated as a result of starting to commission flats as part of the “Nowe Czyżyny” project in Kraków.

Already for the ninth year in a row, due to good results in 2016 and high cash level, the Management Board recommended a payment of dividend and allocation of the entire net profit generated in 2016 for this purpose. The General Meeting of Shareholders will make a final decision on this matter on 11 May 2017. The dividend paid out in June 2017 would amount to a historic high of PLN 14.99 gross per share.

We are not changing our plans concerning our human resources policy — we are planning to further increase employment in 2017. In the first quarter, we employed almost 200 people in the Budimex Group in the home market. At the same time, in 2017, we will have to face the rising pressure on wage growth and further decrease in the availability of skilled workers. Our focus in the following quarters will be to build a profitable order book for subsequent years. However, increased competition in bidding to GDDKiA, high price pressure, and long tender procedures can hinder reaching a satisfying level of awarded contracts in 2017. We will also have to address the issue of the observed increase in the prices of raw materials and subcontractor costs in the nearest future. Thus, particular care for costs on contracts performed and responsible approach to calculating new bids will be of utmost importance.

BUDIMEX Group

Financial highlights from the consolidated financial statements of the Budimex Group prepared in compliance with the International Financial Reporting Standards (IFRS) for the first quarter of 2017 and comparable data for the first quarter of 2016.